The Ledger

Curated content foranalytical business leaders

Should Standard Costing Be Used for Decision Support?

Most manufacturing organizations use standard costing as the default mechanism to cost their products, inventory and estimate the cost of manufacturing activities at each step of completion.

This isn’t news or a surprise to anyone. Organizations began using standard costing in the 1920s – and not much has changed since then. Because most companies already use standard costing, new competitors must also use it to help analysts make apples-to-apples comparisons.

However, what this means and how this costing method impacts an organization’s overall profitability and optimization should be considered.

Let’s break that down a little further:

- Using standard costs, the organization spends several months gathering inputs for things like raw material prices, labor rates, machine and labor productivity, department spending, etc.

- The cost accountants determine how to allocate overhead costs across departments and product groups.

- At the end of the process, the cost accounting team rolls the cost from raw materials through work in process, and then, finally, through finished goods.

As the final step, business stakeholders receive a summary of the costs per product for the next year when performing calculations in decision-making.

What we need to be aware of is that the moment a standard cost is produced, it is out of date – and understanding the relationships between all of the inputs, processes, and calculations is nearly impossible.

Even more, the standard cost activity and cost rates are all determined using a singular scenario for production and sales volumes. The moment any of the following shifts, the standard cost’s accuracy is in serious trouble:

- Labor rates

- Production/sales volumes

- Production yields

- Labor/machine efficiency

- Product mix

- Product raw material input and skin board packaging prices

- Shipping costs

- Contract manufacturing rates

Should standard costing be used for decision support?

So, if these costs are changing, and your standard cost isn’t, should you still use it for decision-making? Can you really wait until the next budget cycle when the standard cost is updated again to get an updated cost of producing and selling your products? And how is this all affected at a time in increasingly competitive and volatile economic conditions?

How should standard costing be used in a business?

The above may not be a true revelation or “ah-ha” moment for product costing teams; “Yeah, we know this stuff already,”…“It’s the only tool we’ve got. What else should we do?”…sound familiar?

There is a two-part answer to solving the standard cost problem for manufacturing organizations:

- First, a business does need a standard cost; something in place to value inventory movements throughout the production environment. The standard cost can’t be $0 – so, instead, use a relatively simple process to create a standard cost. All inputs can be $1 or $.01, so long as everything has a value in the ERP system.

- The second part of the solution is that organizations need to recognize the limitations of working through an ERP system that is not purpose-built for a specific organization or industry and takes a long time to produce outputs of little value. Instead of working through the ERP system, organizations should work around the ERP System to get better results.

What should organizations do instead of using standard costs for decision-making?

Let’s talk about how best-in-class organizations are arriving at their true cost to manufacture their product – thus understanding product/customer profitability and optimizing decision-making.

We all know there are many things an ERP system does well: it captures transactions from receiving, consuming, inventorying, and issuing goods for shipment. The ERP captures data from business processes – that is what it should be used for.

The second part of the solution is identifying and implementing a product costing software that integrates with your ERP and other business systems that house crucial data related to product costing and customer profitability.

With specialized product costing software, one advantage is that the same standard costing process can be replicated with even more flexibility; adjustments to actuals are able to be incorprated into the costing model in real-time. Even more, each step of the standard costing process can be seen, understood, and explained – so your team will know where costs and inefficiencies accumulate across the business.

Additionally, with specialized product costing software, you can update all or some of your product cost estimates at any time (And yes, they have write-back capabilities to the ERP). Perhaps the best part of this setup is that an organization can even create multiple product cost estimates for various scenarios.

Leveraging the appropriate tools to calculate the actual, standard, forecasted, and simulated costs of products accounts for the real variables and drivers that exist in an organization. With this improved systems setup in place, your organization can finally get the product costing insights needed for intelligent decision-making and a process to help your organization thrive instead of just trying to survive when seeking to maximize product profitability.

Conclusion

For organizations that wants to leverage their understanding and insights into product profitability as a competitive advantage, there has never been a better time to make a change and adopt the right tools to facilitate this transition. For too long, organizations and product costing teams have had to make do with rusty ERPs and out-of-the-box standard costing processes. However, the technology is finally ready for organizations who understand that product cost clarity is and should be a critical competitive advantage.

Investing in the right tools to fully (and finally) grasp each element of product cost and profitability is a strategic move that pays dividends. Because, remember, your competitors probably haven’t figured out how to solve this problem yet, either. = )

Achieving End-to-End Supply Chain Cost Transparency: Unveiling Insights for Enhanced Profitability

Supply chain cost transparency is a critical aspect of business operations that enables companies to gain a comprehensive understanding of the costs involved in moving products from manufacturing sources to the end customer. By identifying and analyzing various cost elements within the supply chain, businesses can optimize their operations, pricing strategies, and customer relationships.

Flexible 3PL warehousing plays a pivotal role in achieving supply chain cost transparency, offering businesses the agility needed to adapt to market fluctuations and varying customer demands. These warehousing solutions provide scalable storage options, allowing companies to adjust their space requirements based on seasonal trends and inventory levels. Skilled workers, including forklift operators with training from fork lift licence Melbourne, are essential in managing these dynamic environments, ensuring efficient and safe handling of goods.

By partnering with Tactical Logistic Solutions, businesses can leverage advanced technologies and data analytics to track and manage their inventory more effectively. This partnership ensures that storage and handling costs are optimized, contributing to a more transparent and efficient supply chain.

This article explores the importance of cost transparency in the supply chain and highlights how visualizing the cost and profitability waterfall, calculating customer profitability, and employing a cost-driver approach can lead to enhanced profitability and informed decision-making.

Understanding Supply Chain Cost Elements

To achieve end-to-end supply chain cost transparency, it is essential to identify and analyze all the costs incurred throughout the supply chain. The simple answer is – supply chain costs include all the costs incurred to move products from the manufacturing location to the final customer location. It’s a two-step process. First, identify each step in the supply chain and calculate its fully loaded costs. And second, determine how each of these fully loaded costs is differentiated by product and customer.

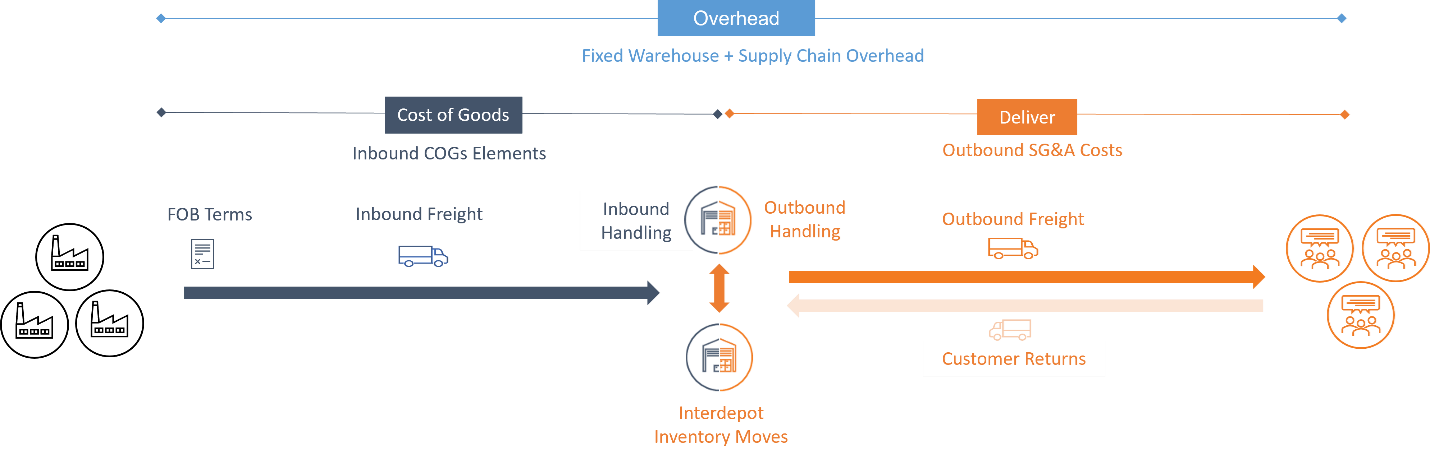

This diagram lays out the basic cost components of a typical supply chain where products are sourced from a variety of manufacturing points, shipped to distribution points, and then delivered to customers.

- Cost of Goods: Differentiating shipping terms, inbound freight, customs clearance, tariffs, and demurrage costs.

- Inbound Handling: Assessing costs associated with receiving, labeling, packaging, and putaway of products. Ensuring forklift operators have proper training and certification, such as those offered by forkliftacademy.com, can contribute to operational efficiency and safety, thereby impacting overall cost management within the supply chain.

- Distribution Network: Breaking down costs related to storing products and moving them to the final point of distribution.

- Outbound Handling: Analyzing pick, pack, and ship costs based on product requirements and customer orders.

- Outbound Freight: Understanding the costs associated with different shipping modes and aligning them with customer delivery requirements.

- Reverse Logistics: Measuring costs related to returns and identifying customers and products that drive significant returns activity.

- SG&A and Overhead Costs: Identifying and measuring the costs of sales, customer service, and other customer-facing functions.

The Cost and Profitability Waterfall:

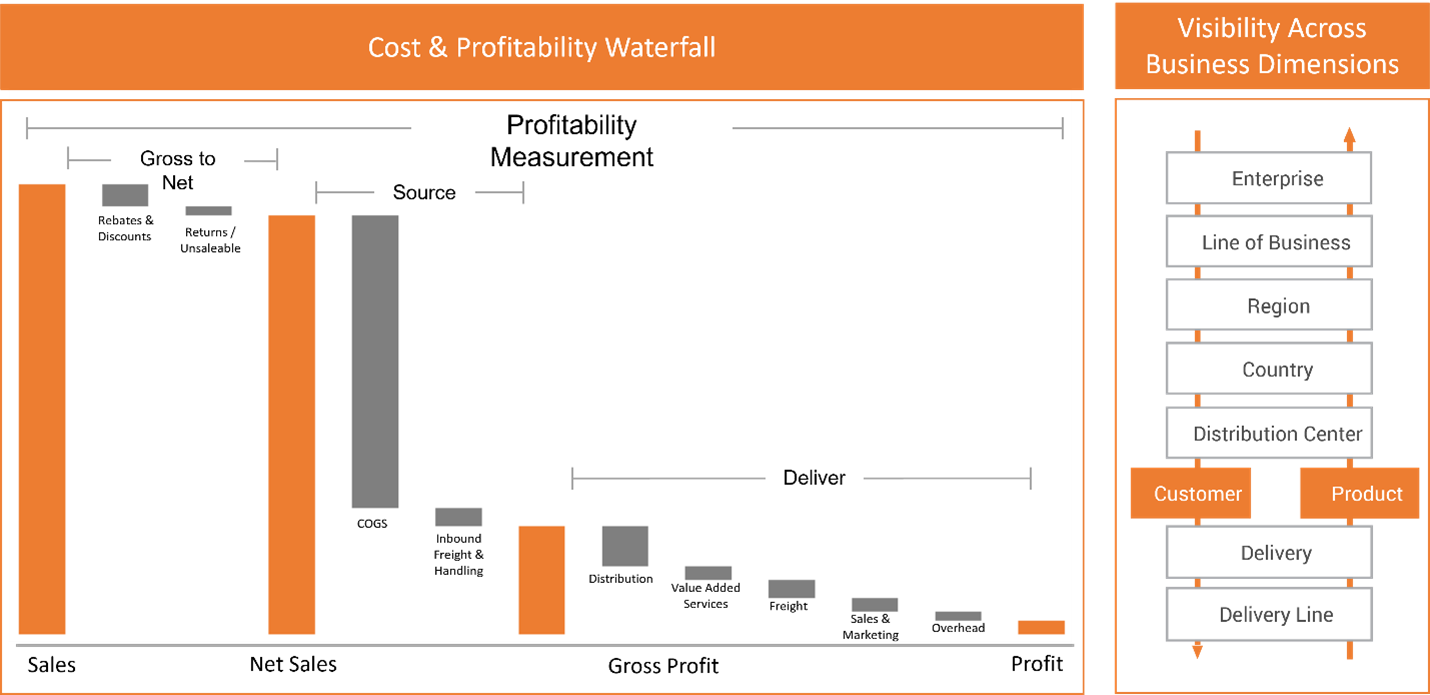

The cost and profitability waterfall provides a holistic view of the cost and profitability of the entire supply chain. By visualizing the cost components and their impact on profitability, businesses can make data-driven decisions.

Generate cost and profitability waterfall views at various levels within the business hierarchy, allowing for a comprehensive understanding of costs and profitability. The lowest level of granularity, such as individual sales transactions, allows you to analyze the cost and profitability of each transaction. Then summarize this detail at each level by aggregating the costs and profitability at higher levels, such as by the delivery or order, customer, or product.

At the customer level, the cost waterfall helps identify customers with high service costs, enabling targeted conversations for improving efficiency and reducing costs. Similarly, analyzing product costs supports informed negotiations with vendors and suppliers, optimizing pricing, terms, and agreements. Additionally, benchmarking different nodes in the supply chain facilitates operational improvements and better overall performance.

Overall, the cost waterfall visualization enables transparency and clarity in assessing the end-to-end cost structure of the business, facilitating informed decision-making and identification of areas for optimization and improvement.

Calculating Customer Profitability:

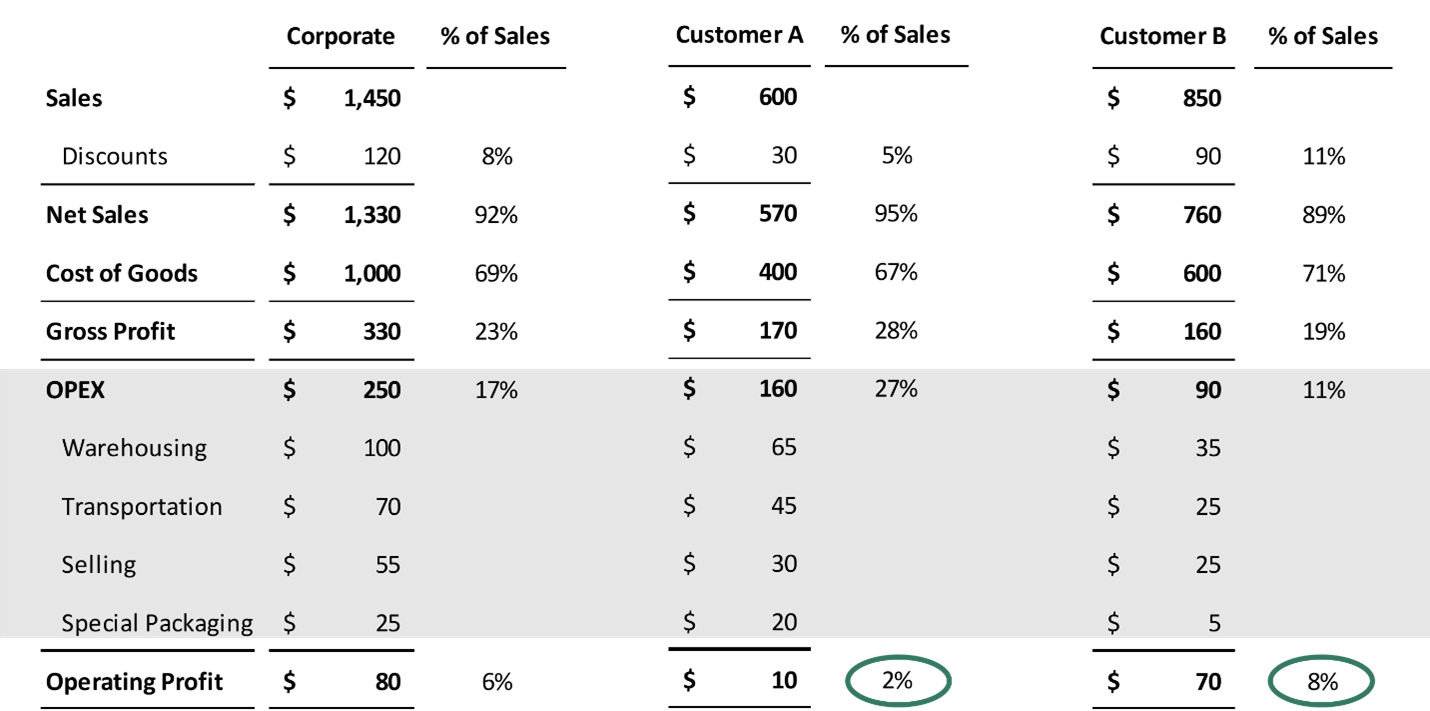

Calculating customer profitability can be complex, especially when allocating operating expenses to individual customers. Many companies use a simplistic approach based on the proportional allocation of operating expenses to sales. However, this method has limitations, as it assumes a direct correlation between sales and associated expenses.

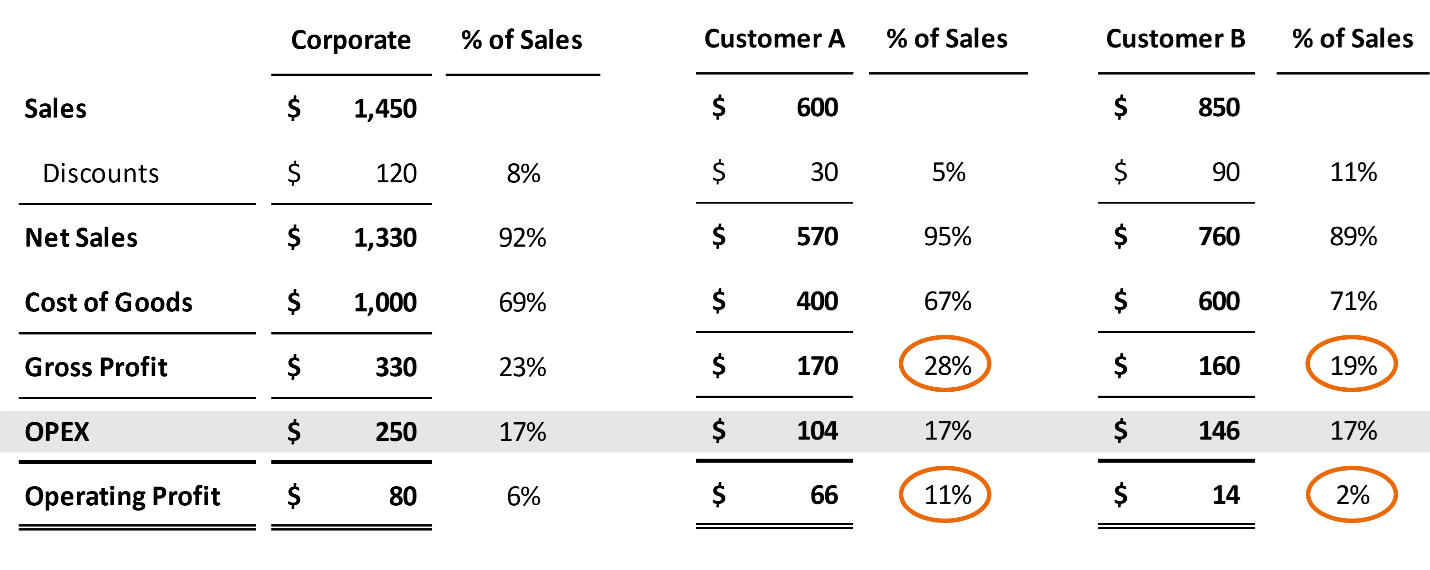

This means that the percentage of operating expenses to sales at the corporate level is assumed to be the same for each customer. For example, if operating expenses represent 17% of total sales at the corporate level, both customer A and customer B would be allocated 17% of their respective sales as operating expenses.

This means that the percentage of operating expenses to sales at the corporate level is assumed to be the same for each customer. For example, if operating expenses represent 17% of total sales at the corporate level, both customer A and customer B would be allocated 17% of their respective sales as operating expenses.

However, there are limitations to this method. Sales do not always correlate directly with the associated expenses incurred to serve each customer and using sales as a sole basis for allocating operating expenses can lead to misleading profitability analysis. The relationship between sales and expenses is often directional at best, and there is no guarantee that higher sales automatically translate into higher profitability.

To gain a more accurate understanding of customer profitability, a cost-driver approach is recommended. This involves breaking down the income statement and identifying specific activities or services associated with operating expenses. By allocating costs based on these drivers, businesses gain a more accurate understanding of how costs are incurred for each customer. This approach considers factors beyond sales and provides insights into the profitability generated by individual customers. It allows management to take targeted actions to improve efficiency, reduce costs, and optimize pricing, service levels, or processes.

In the example provided, it turns out that customer A is more profitable than customer B based on gross profit and gross margin analysis and a sales based allocation of operating expenses. This insight may guide the company in decision-making, such as exploring opportunities to expand and grow the business with customer A while potentially entering negotiations with customer B to adjust prices or reduce discounts. This makes sense based on a proportional allocation of OPEX but may be wholly inaccurate if it turns out that customer A’s share of OPEX is higher than customer B’s based on their service requirements.

Real-World Impact:

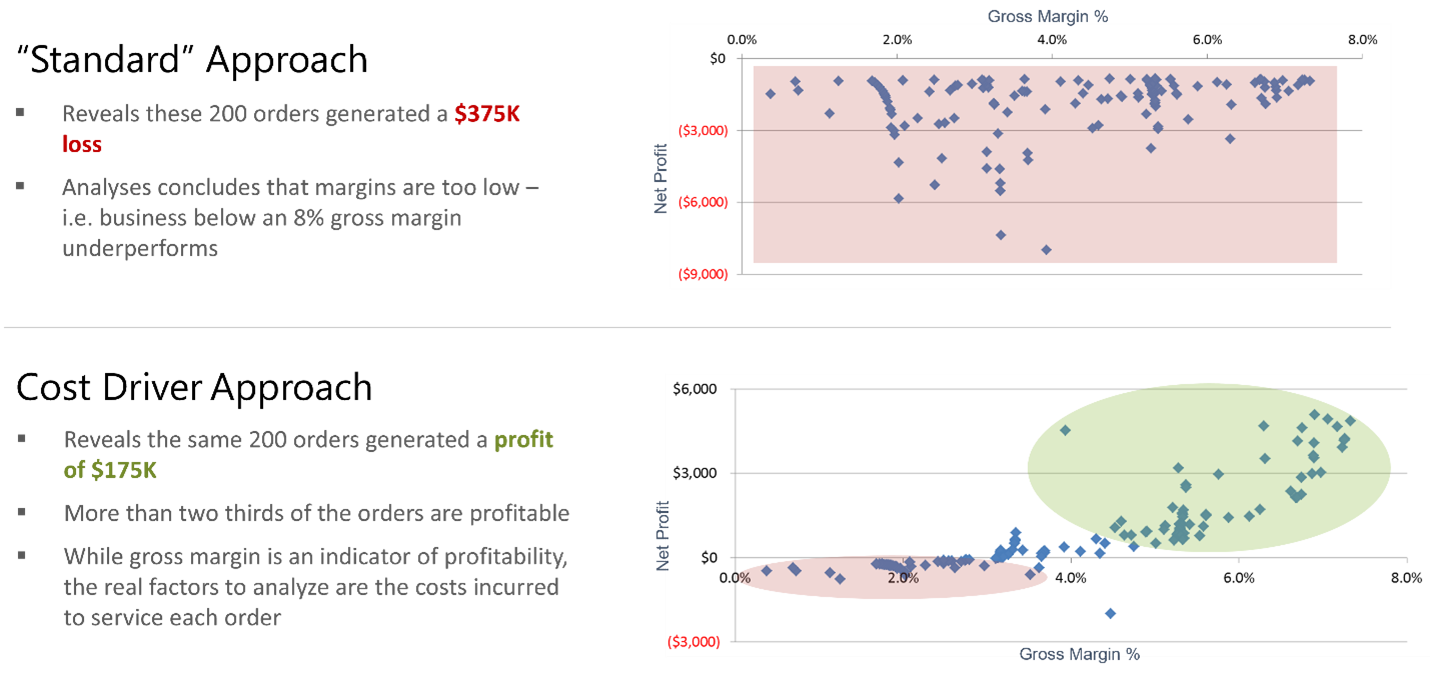

A real-world example illustrates the impact of different profitability calculation approaches on business decisions. Initially, using a generic cost allocation approach, the customer concluded that orders with gross margins below 8% were unprofitable. However, when a cost driver-based approach was applied, it was revealed that the level of service required to fulfill each order significantly impacted profitability.

By considering specific cost drivers, it was revealed that these orders actually generated an overall profit of $175K when actual costs were calculated using the cost driver approach, as opposed to a loss of $375K when using the generic cost allocation approach.

This example highlights the importance of using a more accurate and detailed approach to profitability analysis. By incorporating cost drivers and aligning costs based on the specific activities and services associated with each order, the customer shifted their focus from setting minimum gross margin targets to optimizing customer behavior in order to reduce the expenses incurred in servicing their demand. By understanding the true profitability of each order, they were able to make more informed decisions about pricing, customer segmentation, and operational improvements.

Conclusion:

Achieving end-to-end supply chain cost transparency is crucial for businesses to optimize their operations and enhance profitability. To learn how 3C Software helps companies improve their product and customer profitability analytics process, visit www.3csoftware.com

Your Customer Quote Prices Can Be Back-of-the-Envelope Math or Based on Actual Costs

A new, exciting request comes in for a product you’ve never made before. How do you evaluate the cost of designing, producing, and delivering this order? And how do you do it quickly?

Well, if you’re like most organizations, you do what you’ve always done. You jump right into action and open a state-of-the-art Excel template. And by “state-of-the-art,” you mean the same one you’ve used for the last ten years.

You may log in to your ERP system and export material and labor cost values to get the data needed.

Then you piece together the different data sets in Excel, make a few tweaks to account for changes in yield and batch size, and voila! You’ve calculated the cost to produce the new item for your customer! You set a price, get the quote signed, and it’s time to rock.

But, if you’ve been around the cost accounting world, the above likely has you scratching your head. And for those with even more experience, you can count the times you’ve heard this scenario pitched before but failed to play out in reality.

What’s going on?

Take a few steps back and analyze the process; you’ll see that many areas are missed when using Excel templates. There are real problems with using Excel to calculate costs, along with the usual spreadsheet problems like manual data entry, limited system integration options, problems with incomplete or missing data, and maintenance problems.

Let’s explore some challenges of calculating costs for manufacturing newly quoted products and learn how to establish Cost-Based Quoting (CBQ) programs to prevent them and improve overall costing processes.

Excel Inputs and Formulas Often Remain Unchanged for Months or Years

Using accurate product costs and Excel templates to develop new price quotes can be challenging for both small businesses and finance teams with a lot of experience.

In many Excel templates, the inputs and formulas remain the same for extended periods, making it challenging to keep up with changing market conditions and leading to inaccurate data that cannot accurately reflect the current cost of goods or services. Additionally, manual calculations using Excel templates are labor-intensive and prone to human error.

Even worse, it’s easy for spreadsheet costing templates to become overly complicated, so debugging and mapping how they work becomes entangled like a bowl of spaghetti. When this happens, quoting or financial teams often default to plugging in a few inputs and accepting whatever output the spreadsheet generates.

To ensure accurate and up-to-date pricing calculations, businesses may benefit from specialized product costing software that supports Cost-Based Quoting (CBQ) activities instead of traditional Excel templates. These tools give more accurate cost estimates in seconds and cut down on the need for manual quoting.

If you start by building current products in an appropriate cost-quoting tool, all inputs are identified, understood, and controlled – increasing accuracy, flexibility, and visibility. This makes it easier for you to handle more complex scenarios and give your business a solid foundation for growth. You can also use this product quoting tool to track changes over time, identify areas where profits are made, or create additional value.

Cost-Based Quoting software can centralize input and labor cost data to update pricing and quotes quickly in response to changes in market conditions or unique customer requirements. The most up-to-date cost data gives you the necessary insights to make informed spending decisions and enable cost-effective processes.

Many Organizations Calculate Quote Costs in Excel While Costing Data is Inside the ERP System Because Marrying the Two is Complicated

One of the biggest challenges with developing cost estimates is accessing information at the right granularity level to determine the project’s actual cost. Finance teams typically struggle to calculate cost estimates because they lack a way to centralize relevant cost information effectively.

No matter what, extracting data from complex systems like ERPs into Excel templates means losing a degree of context critical to understanding the cause-and-effect relationships. Integration can lead to errors in price quoting and incorrect cost estimates.

A Cost-Based Quoting system can provide organizations with the ability to accurately create price quotes by combining data from disparate systems into a single platform. Providing real-time access to cost data means organizations can improve their quoting accuracy and reduce human errors that could lead to costly mistakes or customer dissatisfaction.

Additionally, access to reports and analysis on the effectiveness of different quote strategies enables organizations to make better-informed decisions about pricing to improve their operational efficiency and profitability.

How Do You Accurately Estimate the Costs of Different Variables of Custom Orders?

A challenge when costing new products is determining the cost structure when no exact setups are already in place. Manufacturing organizations have long struggled to accurately determine the price for custom orders, especially when factors such as different sizes, ingredients, yields, labor requirements, and machine usage are considered.

A new process may require additional labor, training, new machines, and techniques the manufacturing team hasn’t encountered before. While each of these items might seem like simple replacements with new SKUs and configurations, the reality is often more challenging than that; this is where new costs are misunderstood.

For many finance teams, the Excel templates and processes they use to develop cost estimates don’t incorporate these points. Excel spreadsheets can only go so far before they become too big and complex. In many cases, quoting and finance teams settle for a rough, “good enough” estimate based on what they know and can see at the time and use that information to calculate prices.

Fortunately, with the emergence of Cost-Based Quoting solutions, those in the manufacturing sector can more efficiently calculate accurate prices for custom orders. This approach allows you to create sophisticated yet user-friendly models that simultaneously consider all the necessary factors and deliver the correct result quickly and easily. CBQ reduces the potential for errors that could lead to costly mistakes and ensures consistent pricing across multiple variations of products.

Another focus of CBQ programs is making historical quote data available to copy and modify, establishing a more efficient way to calculate prices for new items. It enables you to quickly leverage current cost structures and knowledge for similar items, saving time and resources. This approach also ensures that all necessary cost components are accounted for when creating pricing estimates.

Beyond cost calculations, Cost-Based Quoting programs also include the ability to calculate how costs will fluctuate with different volumes or product specifications so that customers can make better-informed decisions about their projects.

In addition to providing accuracy and speed, these solutions offer detailed insight into the cost of each order to create a more transparent quoting process.

Excel Can’t Perform Comprehensive “What-If” Analysis

While Excel can do many things, what is lacking in capabilities is sharing how small changes can cascade across an entire organization.

- If labor increases by $2/hr in the next 12 months, how will that affect the cost estimate?

- What does that mean if utility rates decrease by 30% for electricity but increase by 20% for gas in the next 6 months?

- If the organization needs to buy a new machine vs. using what is already on site, how do those options increase or decrease the total cost?

The considerations above matter; if you use Excel templates to estimate product cost, there is no way to have an accurate, quick answer – especially for organizations that produce many products, including custom products, and have various functions, locations, and business models.

“Without a way to test the cost impacts of marketplace changes, your organization’s profits are at risk with every project or quote you win.”

Again, generating quotes and analyzing potential scenarios and costs can help you make sound decisions around sourcing, conversion, prices, or any other variables that impact the overall profitability of the product.

How Do I Solve the New Business-Quoting Problem?

Excel templates are a popular tool for cost estimates, but unfortunately, they often lead to shifting assumptions and inaccurate results. To avoid this problem, organizations should use Cost-Based Quoting tools like ImpactECS to establish a robust costing and pricing process.

A product costing system that systematizes the quoting and pricing process and integrates with other systems makes it possible to provide accurate and timely customer quotes and reduce the risk of errors.

By understanding the actual costs associated with producing and delivering your product or service and calculating a fair price that reflects its value to customers, you can create customer quotes that are both attractive to buyers and profitable for your business. With this knowledge, you can start setting prices to help grow your bottom line while ensuring a positive customer experience.

Conclusion

With the correct cost-estimating tool, you can make informed decisions tailored to your business’s needs and goals. These tools give you confidence that your costs are well controlled while allowing for flexibility as market conditions change.

Cost-Based Quoting processes help businesses reduce risk and increase efficiency by appropriately allocating resources to suitable projects, ultimately leading to increased customer satisfaction, greater profitability, and sustained growth.

Learn more about how ImpactECS helps organizations establish Cost-Based Quoting Programs at https://www.3csoftware.com/solution/cost-based-quoting/.

CFO Dive: Unlocking the ‘Right’ Combination to Digital Transformation

“CFOs and their C-suite counterparts are looking to investments in new technology as a means to both place their business in a position adept for growth, while also trimming costs wherever possible.”